Financial Education

Vault: Understanding Money

- Credit and Borrowing

- Financial Decision Making

- Future Planning

- Income and Careers

- SPending and Saving

Why Adopt This Course?

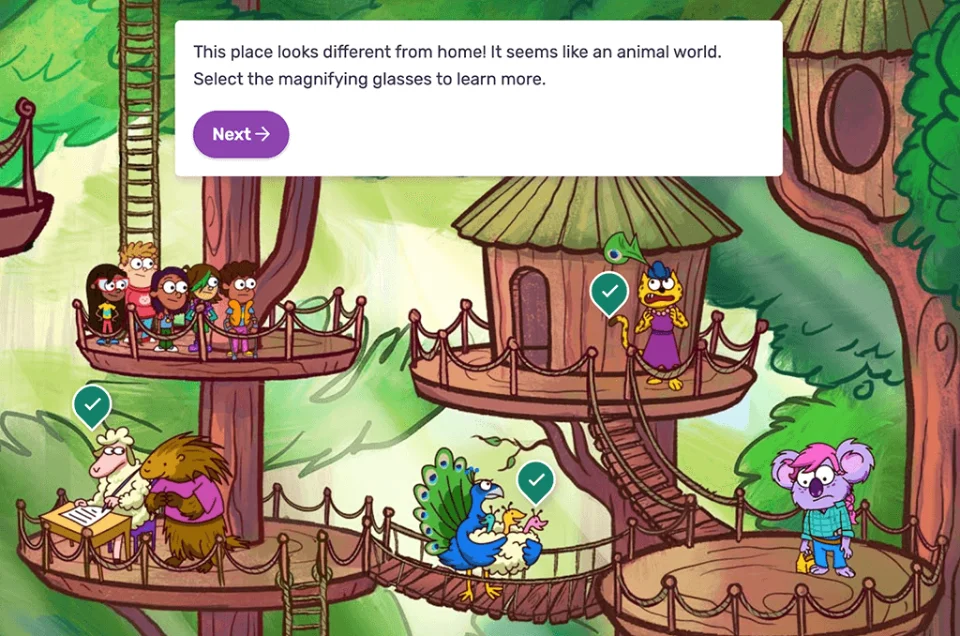

Introduce essential money concepts through engaging, game-based learning designed specifically for elementary students. Vault: Understanding Money combines financial education with social-emotional learning skills, helping young learners build healthy money habits through interactive stories and real-life scenarios. Students explore fundamental concepts like spending, saving, earning, and making smart financial choices through an immersive experience featuring diverse characters and age-appropriate activities. This comprehensive course builds the foundation for lifelong financial wellness while fitting seamlessly into math, social studies, or life skills curricula with complete lesson guides and minimal prep time required.

At-A-Glance

Grade Level

4th, 5th, 6thLength

5 digital lessons, 15 Minutes / 75 Minutes

Languages

Standards

Math Common Core Standards and ELA Common Core Standards

Curriculum Fit

Social Studies, ELA, Math, Family and Consumer Science, Morning Meeting

Student Learning Objectives

- Financial Decision Making

- Spending and Saving

- Income and Careers

- Credit and Borrowing

- Building Wealth Money

- Managing Games

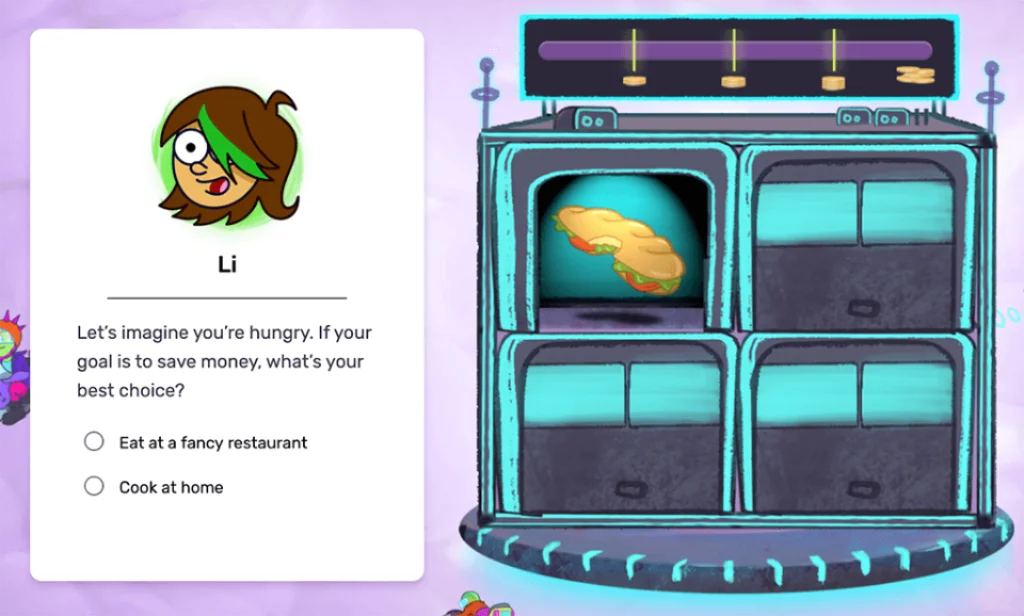

This lesson introduces the concept of responsible decision-making, a key element to long-term financial success and the main focus of the course.

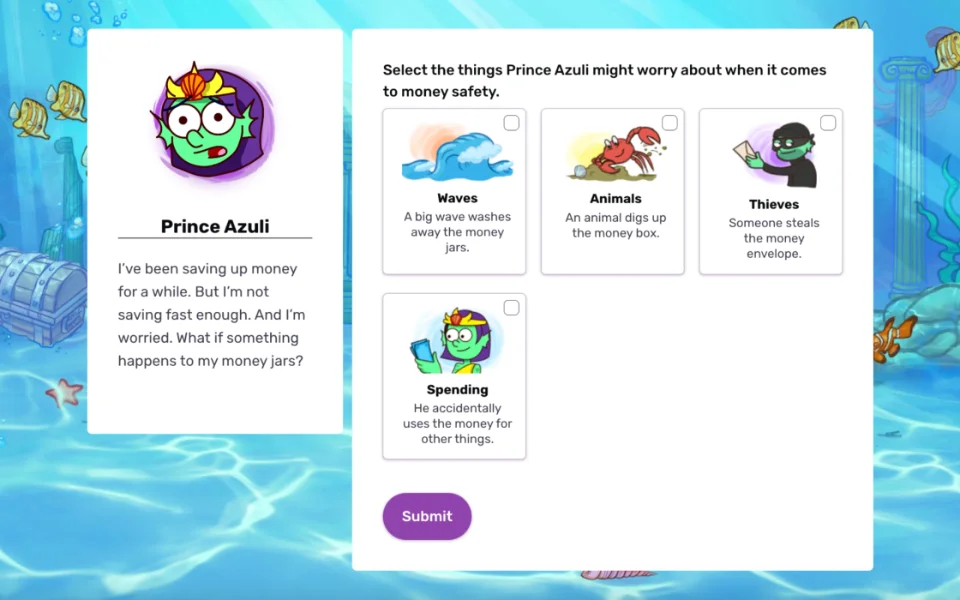

In this lesson, students learn how to set a savings goal, build a budget and shop as an informed consumer.

In this lesson, students learn about choosing a career path based on their skills and interests. Students also learn about income, taxes and the difference between a job and a career.

In this lesson, students learn the basics of borrowing and credit. They learn how to be a reliable borrower and how to manage debt responsibly.

In this lesson, students learn about different types of bank accounts and savings vehicles. Students also explore the concept of financial risk and the need for insurance.

Why EVERFI?

EVERFI empowers educators to bring real-world learning into the classroom and equip students with the skills they need for success-now and in the future. Our curriculum and courses are:

- Loved by 750,000+ teachers

- Aligned to US, Canada, and UK learning standards.

- Real-world lessons that are self-paced and interactive.

- Automatically graded with built-in assessments and reporting.

- Extendable with activities and resources to bring the information to life.

- Supported with a dedicated, regional team.

- Forever free for K-12 educators.

How Are These Lessons Free?

Thanks to the generous sponsorship of corporations who share our mission, EVERFI’s courses are completely free to teachers, districts, and families

This course is made possible through partnerships with community-focused financial institutions who invest in student financial literacy. That’s why everything—curriculum, training, and support—is completely free to educators.